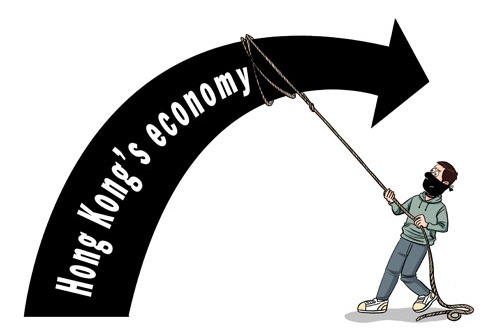

The three months of demonstrations, frequently marked by violence, in Hong Kong have dealt a serious blow to its economy, especially the tourism and retail sectors. Latest statistics show the number of tourists visiting Hong Kong in August reduced by about 2.4 million, a decline of nearly 40 percent year-on-year, and caused an economic loss of about 12 billion yuan ($1.69 billion).

Other sectors, too, have suffered damage. For instance, some logistics companies' turnover has declined 50 percent in recent months. And in the first half of August, the passenger and freight volumes of Hong Kong International Airport declined 11 percent and 14 percent year-on-year.

Logistics, finance, tourism, retail and special services are pillar industries of the Hong Kong Special Administrative Region. The trade and logistics sectors account for 21 percent of Hong Kong's GDP and employ about 25 percent of its workforce. The SAR's gross domestic product has been declining since the US launched a trade war against China, and the demonstrations have further worsened the situation. Many even fear the SAR's economy could step into technical recession.

Worse, the demonstrations' direct effect on Hong Kong's pillar industries might spread to other sectors. In the short term, Hong Kong's tourism industry has suffered huge losses, affecting more than 250,000 employees in the tourism sector and upstream-downstream industries, and their families. But in the long run, the real victims of a turbulent society and sluggish economy will be the youths many of whom have taken part in the three-month-long demonstrations.

Unbalanced internal economic structure, especially the ever-widening wealth gap between the rich and the poor in Hong Kong, is what led to the violent demonstrations. Hong Kong's Gini coefficient, an indicator of the wealth gap between the rich and the poor, increased from 0.43 in 1971 to 0.54 in 2016. In fact, the number of impoverished people in Hong Kong is more than 1 million in a city of just 7 million.

Despite being Hong Kong's second pillar industry, the financial sector employs just 5.5 percent of its total population, although it generates about 17.7 percent of its GDP. Since very few people can get employment in the high-income financial sector, Hong Kong's youths, in general, have become pessimistic about their career prospects and social upward mobility.

Limited opportunities in the high-income sectors have something to do with Hong Kong's industrial structure. The city neglected the technology industry's development during the Third Industrial Revolution, focusing instead on the real estate and financial sectors. The Cyberport project, which many Hong Kong residents believed would expedite the development of the high-tech industry, eventually became a real estate project. And by failing to seize the precious development opportunities, Hong Kong deprived the young generation of a brighter future.

The Chinese mainland has played a crucial role in maintaining Hong Kong's status as an international financial hub. More than 70 percent of the capital in Hong Kong's stock market and over 60 percent of its listed companies are from the mainland. Mobility and safety is crucial for any offshore financial center, which means political and social instability could be fatal to Hong Kong's financial sector.

The violent demonstrations have already damaged Hong Kong's image as an international financial hub, and if the social instability continues any longer, capital will flow out of the city to other global financial centers, causing unbearable loss to its economy.

The SAR government has waived some charges and rents to boost the economy in the short term. But in the long run, it should make efforts to reunite the society by introducing patriotic elements in school and college syllabuses. Also, it should strengthen industrial regulations and social supervision to regain its reputation.

Learning from the advanced systems and experiences of other economies is crucial for an economy's development and prosperity. The mainland did so and developed at an unprecedented pace. As such, Hong Kong should learn from both the mainland and other economies in order to not only boost its economy but also expedite social development.

And it should actively participate in the construction of the Guangdong-Hong Kong-Macao Greater Bay Area and integrate its economy with that of the mainland to regain its advantages.

The author is director of the Institute of Studies for the Guangdong-Hong Kong-Macao Greater Bay Area, Guangdong University of Foreign Studies. The views don't necessarily represent those of China Daily.

If you have any problems with this article, please contact us at app@chinadaily.com.cn and we'll immediately get back to you.